Bitcoin Halving Is Nice, but Kickstarting Bull Run Requires Fiat Money Supply Growth

While bulls point to next year's halving as a bull catalyst, any sizable uptrend is likely contingent on major central banks boosting their year-on-year M2 money supply growth rates, past data show.

The crypto market anticipates Bitcoin's fourth mining reward halving in April 2024, hoping it will trigger a significant bull run, as it has done in the past. However, it's important to remember that previous halvings were not the sole drivers of bull markets. Macro factors, such as ample fiat liquidity conditions, also played a crucial role, according to MacroMicro data.

Bullish reward halvings?

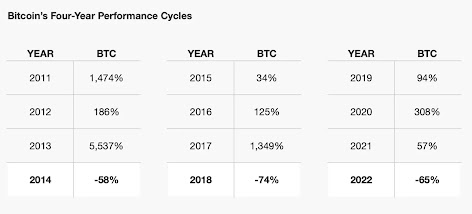

"Reward halving is a programmed Bitcoin event that occurs every four years, reducing the supply expansion rate by 50%. Previous halvings in 2012, 2016, and 2020 led to triple-digit price surges, reaching new highs within 12-18 months before subsequent downtrends. Bear markets typically lost steam around 15-16 months before the next halving. Bitcoin's 56% YTD gain in 2023, following a bear market, aligns with historical patterns."

While the total M2 money supply growth rate has turned positive this year, it remains well below the 6% mark. The Fed and most other central banks have raised rates rapidly over the past 12-18 months to tame inflation, and the probability of renewed liquidity easing in months ahead appears low.

Nhận xét

Đăng nhận xét